The luxury car giant behind Jaguar and Range Rover says it is confident its business will be “resilient” despite Donald Trump’s new 25% tariffs on automobiles.

The US president has imposed a 10% tariff on US imports of UK goods, rising to 25% for cars. Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders (SMMT), called the news “deeply disappointing and potentially damaging”.

The USA is a key market for JLR, formerly Jaguar Land Rover. Last year JLR chose Miami Art Week to launch its Type 00 Jaguar concept vehicle. The car was designed with a theme of “Exuberant Modernism” and the company says it is “a concept with bold forms and exuberant proportions to inspire future Jaguars”.

JLR’s North American business is based in Mahwah, New Jersey, and its LinkedIn page says the company “is represented by more than 330 retail outlets”.

Analysis this week from the Institute for Public Policy Research (IPPR) showed more than 25,000 direct jobs in the UK car manufacturing industry could be at risk under the new tariff regime as exports fall. And the IPPR said employees at Jaguar Land Rover and Mini were set to be among the most exposed.

In a statement, JLR said: “Our luxury brands have global appeal and our business is resilient, accustomed to changing market conditions. Our priorities now are delivering for our clients around the world and addressing these new US trading terms.”

In January, JLR posted a pre-tax profit of £523m for the final three months of 2024, down from the £627m reported during the same period in 2023, as reported by City AM. But its pre-tax profit for the 12 months to date stood at £1.6bn, a 7% year-on-year increase.

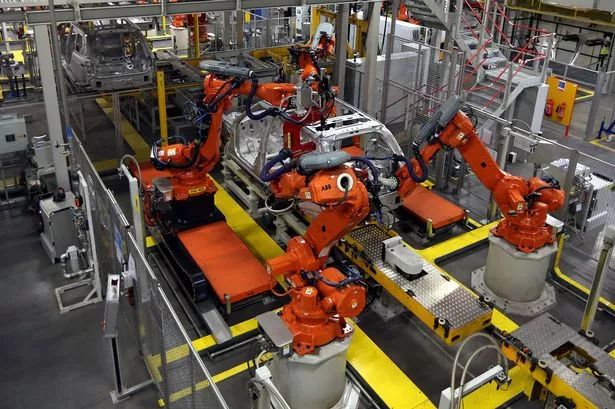

Also in January, JLR said it was investing millions of pounds in new paint facilities at its Castle Bromwich site to help it meet demand for personalised luxury vehicle, where customers pick from hundreds of bespoke paint options across its Range Rover and Range Rover Sport models

In September, JLR announced plans for a £500m investment at its Halewood factory in Merseyside to turn it into the “electric vehicle factory of the future”.

Mike Hawes from the SMMT said: “The announced imposition of a 10% tariff on all UK products exported to the US, whilst less than other major economies, is another deeply disappointing and potentially damaging measure.

“Our cars were already set to attract a punitive 25% tariff overnight and other automotive products are now set to be impacted immediately.

“While we hope a deal between the UK and US can still be negotiated, this is yet another challenge to a sector already facing multiple headwinds.

“These tariff costs cannot be absorbed by manufacturers, thus hitting US consumers who may face additional costs and a reduced choice of iconic British brands, whilst UK producers may have to review output in the face of constrained demand.

15 stunning pictures of Jaguar's new electric vehicle as Type 00 is launched in Miami

“Trade discussions must continue at pace, therefore, and we urge all parties to continue to negotiate and deliver solutions which support jobs, consumer demand and economic growth across both sides of the Atlantic.”

Dr Jonathan Owens, operations and supply chain expert at the University of Salford, said: “While the tax on parts might not take effect until May, the new US tariff import policy imposing a global 25% tax on fully assembled and saleable vehicles has already begun. For vehicles already in the supply chain to the US from the UK and other global destinations, automotive manufacturers will probably have to take the hit short-term for the increases as the price negotiations have been completed.

“However, if the global US tariff becomes a permanent fixture by the Trump administration, automotive companies will not be able to carry the long-term burden of the increased costs. This will become more noticeable when the tariff tax is expanded to the parts supply chain. The assembly of a vehicle requires parts coming into a centralised manufacturing plant, however there will also be decentralised smaller plants and suppliers offering specialised services. Subsequently, component parts in the assembly may cross multiple borders accumulating tariff costs. So, when the tariff on parts takes place, it will only further increase the cost of the vehicle.

“We should also consider this was attempted in Trump’s first presidential office to protect US steel jobs, with a 25% global tariff on imported steel. However, this resulted in a lower job tally of 80,000, compared to the 84,000 it had been in 2018.

“Will it last and is the UK right not to retaliate immediately? The US public will not be isolated to these increases due to the supply chains. If US manufacturers are to bring everything in-house, it would take many years and not everything can be sourced within the US. The US citizen could soon find the price of locally made cars increasing and the option to buy cheaper imports has also become too expensive. The situation is far from ideal for a nation who like their cars.”

Recent

See All2025-05-08

Trump's tariffs are a 'lose-lose' - West Midlands business leaders react to the new import tax

2025-05-08

Rolls-Royce shares surge as Derby-based FTSE 100 firm recovers after Trump tariff scare

2025-05-08

Manufacturer celebrates 'significant milestone' with French Connection deal

2025-05-08

UK manufacturing woes deepening as industry 'hit on several fronts'

2025-05-08

Government delivers support to UK car industry after pressure from manufacturers

2025-05-08

Aston Martin at risk of takeover as Canadian billionaire Lawrence Stroll boosts stake

2025-05-08

Pearson Engineering works on robot mine sweeper being trialled by British Army

2025-05-08

Rolls-Royce stock plummets 10% amid global trade war fears and new tariffs

2025-05-08

Cycling accessories firm secures funding to expand Bristol HQ

2025-05-08

Fentimans runs tight ship to boost profits despite consumer spending issues

Newsletter

Get life tips delivered directly to your inbox!